Choosing the right MT4 indicators for your trading strategy can be a daunting task. With so many available, it can be hard to know which ones are the best fit for your unique needs. However, ex009 can help make the process easier. In this blog post, we will explore some of the top MT4 indicators and discuss how they can be used to increase your chances of success in the markets. Read on to learn more about selecting the best MT4 indicators for your trading strategy.

What are MT4 indicators?

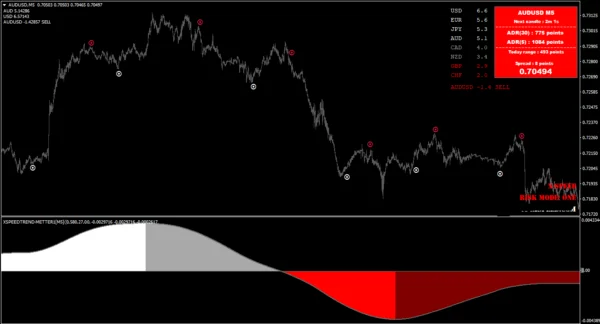

MT4 indicators are specialized software tools used in the MetaTrader 4 (MT4) trading platform. These technical indicators provide traders with real-time data on market movement, allowing them to make informed decisions about when and how to trade. MT4 indicators can be categorized into trend, oscillators, and volume, price and ex009 indicators. Trend indicators identify the overall direction of the market, such as uptrends or downtrends, while oscillators help traders spot overbought and oversold conditions in the market. Volume indicators measure the amount of trading activity that is occurring, while price indicators measure changes in prices of a security or asset. Ex009 indicators use a mathematical formula to analyze data points, allowing traders to identify patterns in the market and make informed trading decisions.

How do I choose the best MT4 indicators for my trading strategy?

Choosing the best MT4 indicators for your trading strategy is essential for successful trading. There are a wide variety of indicators available for use on the MetaTrader 4 (MT4) platform, and it can be overwhelming to decide which ones to use.

The first step in choosing the best indicators for your trading strategy is to identify your goals and objectives. Are you a day trader? Swing trader? Position trader? Do you focus on one particular asset or multiple assets? Having a clear understanding of your goals and objectives will help narrow down the list of indicators that can help achieve them.

Once you’ve established your trading goals, consider which indicators best suit your style of trading. Many traders rely on a combination of technical analysis and fundamental analysis when making their decisions. Technical analysis is often used to identify patterns, trends, and potential areas of support or resistance. Common technical analysis indicators include moving averages, relative strength index (RSI), Bollinger bands, and stochastic oscillators. Fundamental analysis looks at macroeconomic factors such as inflation, interest rates, and economic growth to determine whether a currency pair is undervalued or overvalued. Common fundamental analysis indicators include news events and macroeconomic data releases.

Finally, it’s important to test any indicators before using them in live trading. This is especially true for technical analysis indicators as they can be easily misinterpreted. Use a demo account to try out different combinations of indicators to see which ones are most accurate in predicting price movements.

In conclusion, choosing the best MT4 indicators for your trading strategy is a personal process. Consider your goals, understand the different types of indicators, and test your strategies before making any trades. With proper research and practice, you’ll be able to identify the most effective indicators for your unique trading style.

What are some popular MT4 indicators?

MetaTrader 4 (MT4) is an incredibly popular trading platform that many traders use to analyze markets and develop strategies. It has a wide range of indicators that can be used to identify trends, spot reversals and even set up automated trading strategies. Among these indicators are some of the most popular indicators in the world.

Moving Average (MA) is one of the most commonly used indicators on MT4. It is used to smooth out price data and identify trend direction. A simple moving average calculates the average closing price of a currency pair over a specific time period, while an exponential moving average (EMA) gives more weight to recent prices. Both MA and EMA indicators can help traders recognize when a trend is beginning or coming to an end.

The Relative Strength Index (RSI) is another widely used indicator on MT4. It compares the magnitude of recent gains to recent losses to identify whether a market is overbought or oversold. This indicator can help traders determine when to enter and exit trades.

The Moving Average Convergence/Divergence (MACD) indicator is another popular indicator for MT4 users. It takes the difference between two moving averages and then plots the value on a chart. This indicator is used to identify trend changes and potential buy and sell signals.

Finally, the Bollinger Bands indicator is a technical tool used to measure volatility in the market. The indicator plots two lines above and below the current price, which can help traders detect when a market is getting too volatile or if it is trading in a range. This can help traders decide when it may be time to enter or exit a position.

In conclusion, there are several popular indicators available for MT4 users. Moving average, RSI, MACD and Bollinger Bands are among the most commonly used indicators that can help traders identify trends and make informed decisions about when to enter and exit trades. By understanding how each of these indicators works, traders can improve their trading strategies and increase their chances of success.